As part of his extensive experience leading complex enterprise transformations,

OnDemand Network Partner Christian Hoffmann has spearheaded initiatives that strengthen financial governance, enhance investment transparency, and elevate enterprise execution.

In one such engagement for a

global manufacturing company, Christian led a comprehensive redesign of the organization’s enterprise program management and financial governance model.

The company had long struggled with decentralized budgeting, inconsistent prioritization, and siloed execution. These challenges limited transparency, slowed decision-making, and diluted the impact of strategic investments. Executive leadership sought a more unified, financially disciplined operating model to better support long-term growth and value creation.

Situation Overview

The organization managed a broad portfolio of strategic initiatives each year—ranging from technology modernization to operational efficiency programs—but lacked a cohesive governance structure to oversee them effectively.

Key challenges included:

- No standardized process for project intake, prioritization, or financial evaluation

- Limited visibility into project performance, value realization, and budget adherence

- Overlapping initiatives with unclear ownership and accountability

- Fragmented reporting that delayed executive decision-making

- Inconsistent processes and tools across regions

The organization required a

transparent, centralized, and financially grounded operating model to ensure resources were deployed toward the highest-impact initiatives.

Strategic Approach

Drawing on his background in

financial planning, PMO leadership, and organizational transformation, Christian designed and led the initiative around three core pillars:

1. Establish an Enterprise Project Management Organization (EPMO)

Christian created a centralized EPMO to:

- Implement a unified project intake and evaluation framework

- Prioritize initiatives using financial, operational, and risk-based criteria

- Standardize execution tools, templates, and reporting

- Drive cross-functional alignment and accountability

The EPMO became the authoritative source for portfolio visibility, governance, and performance oversight.

2. Implement Financial Governance & Performance Tracking

To embed financial rigor across the initiative lifecycle, Christian:

- Developed standardized business case models incorporating ROI, NPV, and cost–benefit analysis

- Introduced a disciplined monthly financial performance review cadence

- Built dashboards tracking budgets, forecasts, milestones, and value realization

- Integrated reporting across Finance, Operations, and IT

These measures significantly improved transparency, forecasting accuracy, and investment discipline.

3. Redesign Operating and Decision-Making Models

To address cross-functional bottlenecks, Christian redesigned governance and decision structures to:

- Clarify decision rights and ownership across functions

- Establish clear escalation paths and approval checkpoints

- Align Finance, Procurement, Operations, and IT around common governance standards

These changes accelerated decision cycles and reduced initiative backlogs.

Transformation Execution

Comprehensive Diagnostic

- Conducted stakeholder interviews across Finance, Operations, IT, Supply Chain, and HR

- Reviewed historical investment decisions and value realization

- Assessed PMO maturity and project delivery capabilities

EPMO & Framework Design

- Designed an end-to-end project lifecycle model

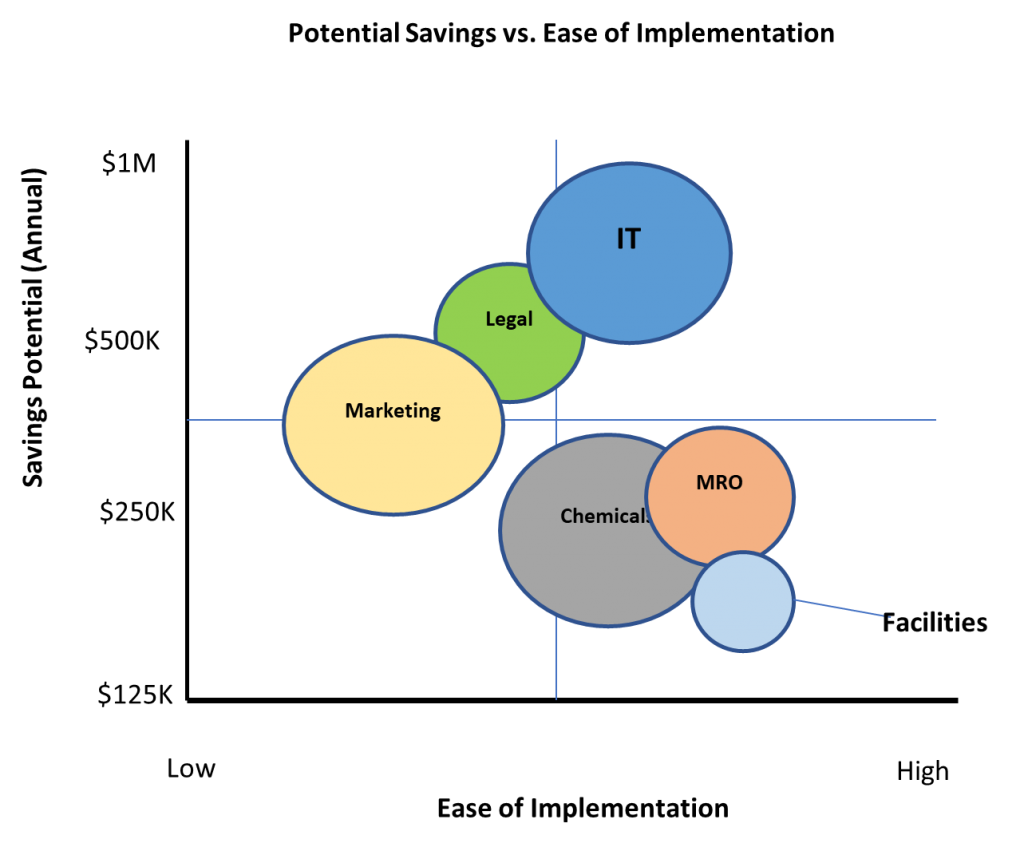

- Built a portfolio prioritization scorecard

- Implemented tiered governance based on financial impact and risk

- Established a monthly executive portfolio review

Toolkit & Process Deployment

- Standardized templates for business cases, risk registers, and resource planning

- Consolidated reporting into unified performance dashboards

- Integrated tools with ERP and planning systems

Change Management & Capability Building

- Delivered training to more than 100 stakeholders

- Defined clear roles for sponsors and steering committees

- Elevated project management expectations across business units

Results

Within the first year, the organization achieved:

- Full transparency into the strategic investment portfolio, including financial, operational, and risk KPIs

- Faster project execution enabled by streamlined decision-making

- Improved budget forecasting with fewer cost overruns

- Higher ROI on prioritized initiatives through rigorous upfront evaluation

- Retirement of low-value or redundant projects, freeing resources for high-impact priorities

- A scalable, enterprise-wide governance model aligned across all functions

Collectively, these improvements strengthened the organization’s ability to manage strategic investments with

clarity, discipline, and speed.

Meet Christian Hoffman – OnDemand Network Member since 2017