Insights

Strategic Sourcing is often associated with driving down cost, efficiency improvement and increased service levels. There are some situations where Strategic Sourcing is needed to help rebuild supplier relationships while enhancing trust all the while securing additional resources for core capabilities. Such is an example of work that OnDemand Professional Network member Chris Vu did for post-bankruptcy period at a hospital serving a major metropolitan area. SITUATION OVERVIEW A hospital in New York had emerged from bankruptcy and needed to stay afloat since it was the largest hospital and biggest employer in its Brooklyn neighborhood. The Materials Management/Purchasing Department was able to manage day-to-day activities to support patient care. However, indirect and ancillary areas were secondary in priority and the suppliers were extremely unhappy losing money as a part of the bankruptcy protection process . Chris was brought in to negotiate new contracts with suppliers to obtain improved terms and ensure uninterrupted service. APPROACH An incumbent approach was taken to help prevent disruptions in service and allow stakeholders to focus on their day-to-day responsibilities. In addition, it was difficult finding new suppliers willing to work with a financially distressed organization. As a part of the approach, Chris not only had to negotiate improved terms, but rebuild trust and rapport with suppliers . Expectations were reset with suppliers encouraging them to view the hospital as a new organization and to look forward and not backwards. The hospital’s group purchasing organization was leveraged as a baseline for pricing and terms . In addition, Chris met with current and potential new suppliers, where available, to support operational improvements for the future. CRITICAL SUCCESS FACTORS Leveraging the current supplier base Rebuilding trust with incumbent suppliers Developing custom pricing outside of the hospital’s GPO Identifying innovative opportunities for the longer term RESULTS Pricing and terms were negotiated to provide annual recurring savings of 11% across 36+ suppliers . 2 to 3-year terms were secured with suppliers to ensure continuous service, and in most instances, pricing better than the hospital’s GPO. Stakeholders were also pleased since they were able to maintain their current supplier relationships and didn’t have to trial or switch to new products/services . Furthermore, a pipeline of potential opportunities was left for the hospital to explore in the future. For example, the hospital could invest in new disposal containers for used needles that optimized storage capacity. Or the hospital could review several rent vs. buy scenarios from wheelchairs to floor mats to mops. Meet CHRIS VU - OnDemand Professional Network Member Since 2020

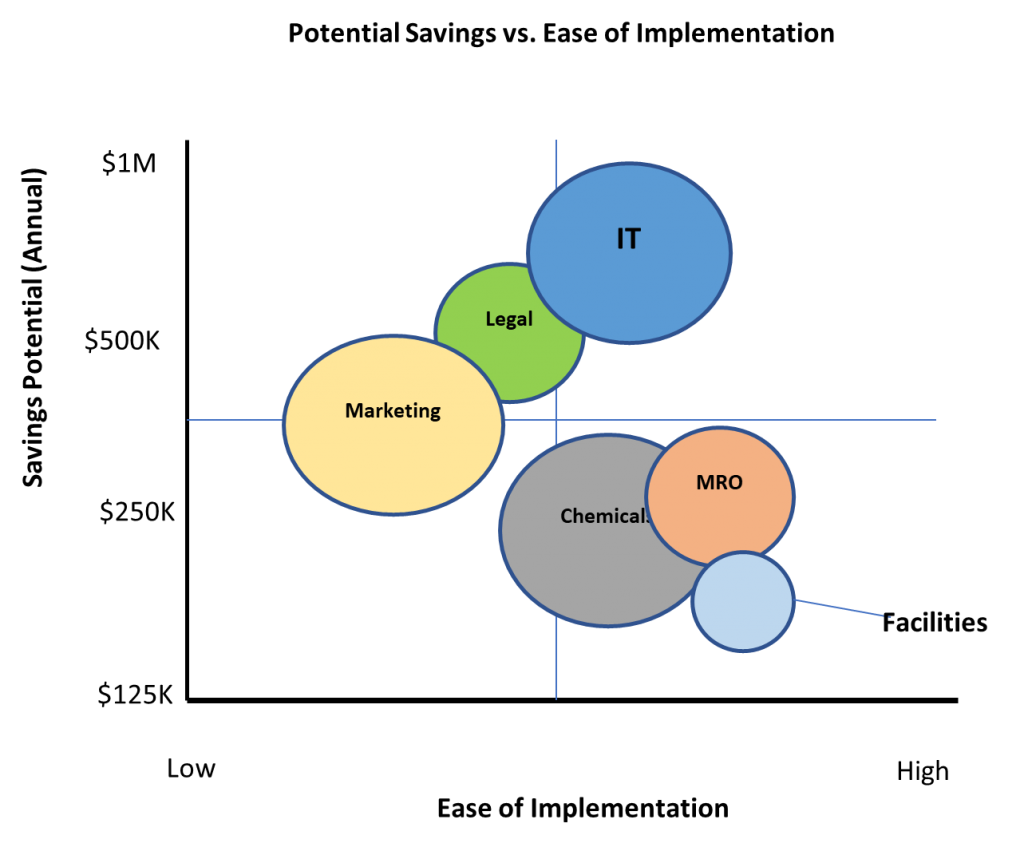

Structured approach, cross-functional leadership and rigorous analytics are key to procurement success. I asked a member of our OnDemand Professional Network Priya Kumar to share her approach. Here is her example. SITUATION OVERVIEW Biotechnology company wanted to establish a procurement function for their $120 MM global external operations. Priya was brought in as a Procurement leader to work with the organization to develop a strategic procurement function to drive savings and improve efficiency. APPROACH She worked closely with engineering teams, product development, manufacturing operations and global planning to understand current processes and business priorities. Additionally, she conducted a supplier activity and spend assessment to analyze the current landscape. A thorough analysis of current challenges and gaps in processes revealed the following: Supplier relationships with significant spend were highly transactional Risk and relationship oversight was complex and arduous Frequent planning and forecasting changes led to additional costs, cancellation fees and high risk exposure Supplier contracts were often one-sided, with limited benefits for the client EXECUTION & BENEFITS Priya successfully crafted a robust category strategy to effectively manage and optimize the $120 million expenditure with suppliers . This strategy encompassed thorough market analysis, supplier evaluations, and strategic sourcing initiatives aimed at maximizing value and minimizing risks. Her next step was to streamline processes across the organization, while building a truly strategic procurement function. She built the foundation for strategic sourcing, supplier relationship management and contract lifecycle management. This fostered harmonization in supplier engagement, elevating the value extracted from deepened supplier relationships. By aligning procurement activities with organizational goals and industry best practices, she also fortified the supply chain operations to withstand dynamic market conditions and unforeseen challenges. In partnership with other stakeholder groups, she implemented robust visibility mechanisms within procurement , leveraging advanced analytics and reporting tools to enhance spend transparency and facilitate informed decision-making. This heightened visibility empowered stakeholders to proactively address potential bottlenecks, mitigate risks, and optimize resource allocation. Priya’s greatest achievement was the immediate identification of several contract re-negotiation opportunities that served as quick wins to show procurement value early. Priya developed the negotiation strategy and conducted negotiations with many key suppliers, ensuring alignment with the category strategy and business objectives. In an ever-changing landscape, Priya showed excellent insight and maturity in making agile decisions that would mitigate loss and risk throughout the lifecycle of the contract. She achieved >$15MM of cost savings for Year 1 & 2 through execution of the newly developed category strategy. By leveraging strengthened supplier relationships and employing rigorous negotiation tactics, she secured favorable contract terms and pricing arrangements, driving tangible bottom-line results while maintaining quality standards and service levels. Meet PRIYA KUMAR - OnDemand Professional Network Member Since 2018

Many organizations benefit from implementing Contract Lifecycle Management System (CLMS). The key issues that implementation of a CLMS addresses include (i) lack of a central repository for contracts, documents, and reports, (ii) lack of direct access to documents outside of the contracts organization (email is used to share documents with employees who are not in the contracts organization) and (iii) potential document version control issues . OnDemand recently helped a client with their initial phase of Contract Lifecycle Management System implementation. I want to share the approach and lessons learned as I believe that you will find them helpful as your organization considers enhancements to the way contracts are managed.

Tom Donatelli Joins OnDemand To Enhance Our Client Service Capabilities And Broaden Our Market Reach

OnDemand Resources, the leading provider of independent project and interim talent in Strategic Procurement, Supply Chain and Operations is delighted to announce the addition of Tom Donatelli, a seasoned senior executive with significant experience driving cost reduction, process efficiency and business effectiveness across Fortune 500 companies as our new Vice President Client Services. In this role, Tom will work with clients on identifying new opportunities for enhancing their business results and engaging the right talent to achieve exceptional outcomes.

By Steve Miller – https://www.linkedin.com/in/stevemiller-coo/ Mike Nolan of SourceSuite.com noted that “the first traces of procurement can be seen throughout ancient history, including the Egyptians in 3,000 BC.”1 Jose Ignacio Lopez de Arriortua made a company’s lead procurement role both famous and infamous over 30 years ago by first helping GM to “save billions of […]

The post CPO Corner – Is Procurement Getting Better, Or Just Older??? appeared first on OnDemand Resources.

March 29, 2023 OnDemand Resources, the leading provider of independent project and interim talent in Strategic Procurement, Supply Chain and Operations is delighted to announce the addition of Gary Long, a seasoned consultant with significant experience supporting clients in their efforts to achieve exceptional results as they pursue cost reduction and efficiency improvement initiatives to the […]

The post Experienced Procurement and Supply Chain Consultant Joins OnDemand Resources To Enhance Client Service Capabilities appeared first on OnDemand Resources.

A global confectionary company with HQ in the US has embarked on a mission to reduce cost and improve strategic supplier relationships. While making strong progress in most areas, Brand and Marketing has been a challenge to engage due to their perception that Procurement lacks subject matter expertise. In order to address this perceived shortcoming, […]

The post BRAND & MARKETING SOURCING – ENSURE SUCCESS BY HAVING DEEP SUBJECT MATTER EXPERTISE, STARTING SMALL AND BUILDING STRONG RELATIONSHIPS appeared first on OnDemand Resources.